Introduction

Have you ever looked at your bank account and thought, “I should feel secure, but somehow I still feel broke”? Or maybe you’ve found yourself splurging on things you can’t really afford, just to keep up appearances. If any of that sounds familiar, you might be dealing with something deeper than just poor budgeting—you could be experiencing money dysmorphia.

Much like body dysmorphia, where someone fixates on imagined flaws in their appearance, money dysmorphia is a warped perception of your financial well-being. It’s when your inner sense of “wealth” or “stability” doesn’t align with your actual financial situation. You could have a decent savings account and still feel anxious about money. Or, on the flip side, you might be drowning in debt but living as if you’re thriving—all because of how your brain processes financial status.

This modern mental tug-of-war is increasingly common, thanks to social media’s highlight reels, the pressure of “success” culture, and the rising tide of financial anxiety. In this blog, we’re going to unpack what money dysmorphia really is, how it quietly shapes your decisions, and most importantly—how to break free from it and rebuild a healthy relationship with your finances.

What is Money Dysmorphia?

Money dysmorphia is a psychological disconnect where your feelings about money don’t match your actual financial reality. It’s not about being rich or poor—it’s about how your brain interprets your financial situation, often in a way that’s distorted, irrational, or emotionally charged.

Much like body dysmorphia—where individuals fixate on perceived physical flaws—money dysmorphia involves a warped internal narrative. People experiencing this may:

- Feel financially insecure, even with a healthy savings account.

- Obsessively save or hoard money, driven by deep fear of financial collapse.

- Spend recklessly, chasing temporary highs or trying to keep up appearances.

- Constantly monitor bank balances, searching for a sense of control or reassurance.

This internal distortion isn’t harmless. It can trigger chronic anxiety, lead to burnout from overworking, or cause irrational financial decisions—like refusing to invest, overspending to cope, or under-saving due to denial.

What causes this skewed financial lens? Experts point to a mix of:

- Comparison culture: Watching others flaunt success on social media fuels feelings of inadequacy.

- Unresolved financial trauma: Past experiences of poverty, debt, or instability can wire the brain for fear.

- Unrealistic societal expectations: The pressure to always be achieving “more” makes enough never feel like enough.

The result? You’re left chasing a version of financial safety or success that might not even be real.

The Psychological Fallout of Money Dysmorphia

Money dysmorphia isn’t just about numbers—it’s a mental tug-of-war that can quietly erode your confidence, emotional well-being, and even your ability to make rational financial decisions. When your perception of money is out of sync with reality, the consequences reach far beyond your wallet.

1. Constant Financial Anxiety: The Fear of “Never Enough”

Many people with money dysmorphia live in a constant state of financial anxiety, even when they’re objectively doing fine. This can manifest as:

- Irrational fears of going broke, despite having savings or a steady income

- Feeling overwhelmed or stuck when faced with money-related decisions

- Guilt or shame for spending, even on essential items like groceries or healthcare

These emotions don’t always match the financial facts—they’re rooted in emotional triggers, not spreadsheets.

2. The Dopamine Trap: Emotional Spending Patterns

Money dysmorphia often feeds into a dangerous cycle of emotional spending. Here’s how:

- Making impulsive purchases for a quick dopamine rush—a fleeting sense of pleasure

- Using spending as a coping mechanism to numb stress or insecurity

- Feeling a high after buying something… followed quickly by regret, anxiety, or self-loathing

Over time, these behaviors can form neurological feedback loops, reinforcing poor financial habits and keeping people trapped in the same destructive patterns.

3. When Net Worth Feels Like Self-Worth

One of the most harmful aspects of money dysmorphia is how it warps your sense of identity and value:

- Believing that your worth as a person is tied to your financial success

- Constantly comparing your lifestyle to curated content from influencers or peers

- Feeling like a fraud when you achieve success, or unworthy of enjoying your money

These internalized beliefs lead to self-doubt, low financial confidence, and even impostor syndrome—especially when someone starts earning more but still feels “not rich enough.”

Money dysmorphia doesn’t just drain your bank account—it drains your mental energy, distorts your priorities, and chips away at your sense of security. The first step in changing that? Recognizing these patterns and understanding they are learned responses, not unchangeable truths.

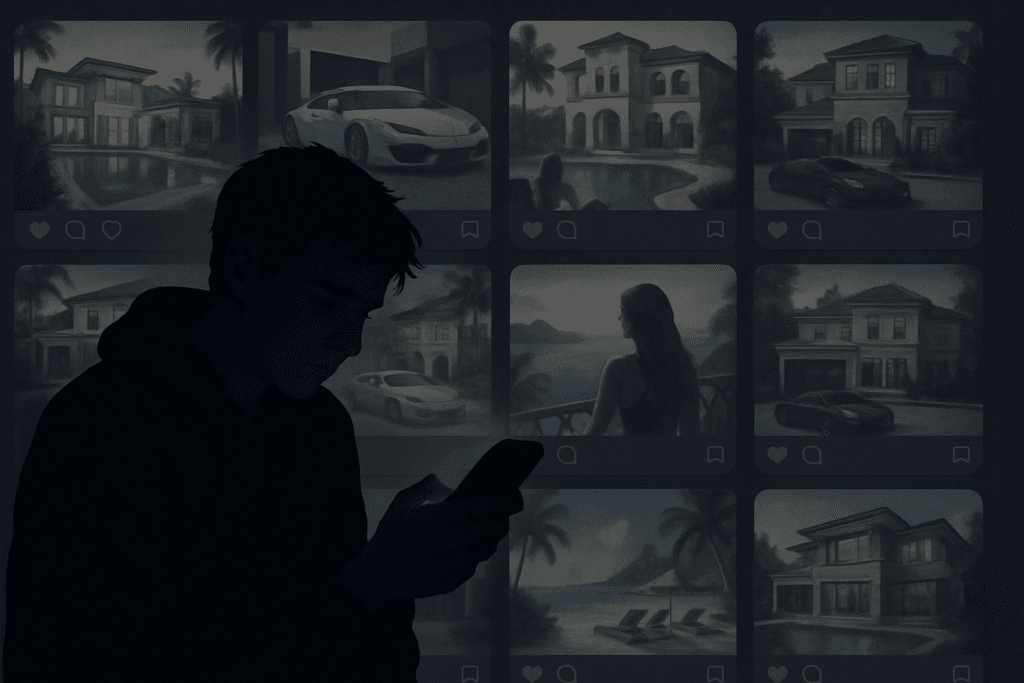

How Social Media Fuels Money Dysmorphia

We scroll, we like, we admire — and sometimes, without even realizing it, we spiral. In the age of social media, wealth is no longer just a personal milestone. It’s a performance. It’s content. And it’s changing the way we think about money in ways we’re only beginning to understand.

🎭 The Hidden Illusion: Why We’re All Falling for the Comparison Trap

Every day, we’re exposed to snapshots of dream lives: penthouses in Dubai, unboxing luxury watches, private jets with champagne breakfasts. But what we rarely see is the context. That $10,000 handbag in the frame? It may have been a sponsorship. That perfect-looking couple in Santorini? Possibly in debt or on a brand-funded getaway.

The real danger isn’t just that we compare — it’s that we compare ourselves to illusions.

Key Insight: Social media isn’t a mirror of real life. It’s a highlight reel, polished and filtered. And when we forget that, we start judging our behind-the-scenes by someone else’s staged performance.

😰 Financial FOMO: The Expensive Side of “Keeping Up”

There’s a new kind of peer pressure — and it doesn’t need a high school hallway to thrive. “What I spend in a day” videos, designer haul content, or luxury lifestyle vlogs create a warped baseline of “normal” spending.

Before you know it, buying a $6 coffee or booking an expensive vacation starts to feel like a necessity, not a choice.

Real Impact: Financial FOMO leads many young people to make impulse purchases just to feel socially relevant. And the emotional fallout? Credit card debt, regret, and long-term money stress.

💔 Money Dysmorphia: The New Anxiety No One Talks About

Here’s something not enough people are saying out loud: Social media is messing with our money self-esteem. You could be earning well, saving consistently, even investing wisely — and still feel like you’re not doing enough.

That nagging guilt? That’s money dysmorphia — the distorted view of your financial reality, shaped by constant exposure to curated wealth.

According to recent studies, this phenomenon is particularly common among Gen Z and millennials, who spend the most time online and are still building their financial foundations.

Think about it: What happens when you never feel “rich enough,” even when you’re financially stable? You start chasing an invisible finish line. And burnout isn’t far behind.

So… What Can You Actually Do About It?

You don’t have to quit social media. But you can build digital habits that protect your mental and financial health:

- Curate your feed: Follow creators who share real, honest financial journeys — not just luxury aesthetics.

- Track your own goals: What wealth means to you may be different from what an influencer projects. That’s okay.

- Practice digital skepticism: Assume every post is a marketing move unless proven otherwise.

Bottom line: Financial freedom isn’t about matching someone else’s lifestyle. It’s about designing your own — on your terms, with your values, and at your pace.

Signs You Might Have Money Dysmorphia

Money dysmorphia isn’t just a buzzword—it’s a real, psychological distortion of how we perceive our own financial situation. And like body dysmorphia, it doesn’t care how “objectively” stable, successful, or secure you are. If you constantly feel like your financial reality doesn’t match your internal fears or self-worth, you may be dealing with this quietly destructive mindset.

Here are some signs to watch for—some of which might hit closer to home than you expect.

1. You Feel Broke… Even When You’re Not

It doesn’t matter how much you’ve saved, or that your bills are paid. You walk around with a subtle sense of dread, as if the rug could be pulled out from under you at any moment.

- You hesitate before buying a coffee, even though you can afford it.

- You experience guilt after spending, even on essentials like groceries or gas.

- You constantly question whether you’re “doing enough” financially—even when you’re ahead of schedule.

Key Insight: Feeling broke isn’t always about your bank balance. It’s often about your emotional balance around money.

2. You Save Obsessively — But It Doesn’t Make You Feel Safer

Saving is smart. But saving out of fear, not strategy, can become a mental trap.

- You say no to fun, self-care, or spontaneous joy—even though your budget could handle it.

- You feel tense or guilty when withdrawing money, no matter the purpose.

- You treat spending like failure, rather than a tool to support your life.

It’s like living in financial “survival mode” all the time — even if you’re far from crisis.

What This Reveals: Sometimes, financial security isn’t a number — it’s a nervous system response rooted in past scarcity or trauma.

3. You Spend to Feel Something — Then Regret It

Ironically, the other side of money dysmorphia can look like overconsumption.

- You impulse-buy to distract from stress or to project success to others.

- You avoid checking your account because facing it feels too overwhelming.

- You experience a high when buying, followed by shame, denial, or regret.

This isn’t just “bad money habits.” It’s emotional coping, disguised as retail therapy.

Hard Truth: Overspending isn’t always about desire. Sometimes, it’s about pain.

4. You Constantly Check Your Bank App — But It Never Reassures You

This is one of the most overlooked symptoms: obsessive account-checking.

- You refresh your banking app several times a day, hoping to feel “safe.”

- Even when your balance is healthy, your anxiety doesn’t ease.

- You can’t rest unless you “see the number” — yet the number never feels high enough.

This compulsive habit can feel like control, but it’s actually a sign of deep insecurity.

What’s Missing: Financial peace doesn’t come from digits alone — it comes from emotional trust in yourself.

5. You Feel Behind — Even When You’re Doing Fine

You see friends buying homes, influencers buying cars, colleagues posting vacation selfies — and suddenly, your own progress feels meaningless.

- You feel pressure to spend just to “keep up.”

- You measure your success by someone else’s highlight reel.

- You’re haunted by the feeling that you’re always behind, even when you’re not sure what you’re racing toward.

Truth Bomb: Comparison turns your financial life into a performance. And performances rarely bring peace.

What Now? The First Step Is Awareness

Money dysmorphia thrives in silence. It lives in the gap between reality and perception, and it feeds on shame. But here’s the good news: once you name it, you can begin to change it.

Steps Toward Healing:

- Track your feelings, not just your expenses.

- Celebrate progress, even if it’s not flashy.

- Follow real people — not just rich ones — on social media.

- Unlearn toxic money beliefs rooted in fear, not facts.

Money health is emotional health. The more honest you are with yourself, the more freedom you’ll find.

Strategies to Overcome Money Dysmorphia

Money dysmorphia isn’t just about numbers — it’s about narrative. It’s the internal story you’ve been telling yourself about what financial success should look like. The problem? That story is often built on fear, comparison, and unrealistic expectations.

If you’re ready to stop spiraling and start healing, these strategies will help you transform how you think, feel, and act around money — from the inside out.

1. Stop Guessing. Start Knowing. (Practice Financial Mindfulness)

Most financial anxiety doesn’t come from being broke — it comes from not knowing where you really stand.

- Instead of letting emotions dictate your financial decisions, ground yourself in facts. Look at your income, savings, debt, and expenses without shame or panic.

- Use a simple journal or notes app to track purchases — not to restrict yourself, but to understand yourself.

- Start a “financial gratitude list”: Did you pay your rent on time? Afford groceries without stress? Those are wins. Name them.

Mindfulness isn’t about control — it’s about clarity. You can’t fix what you won’t face, but once you see it clearly, it loses its power to scare you.

2. Design Goals That Fit Your Life — Not Instagram’s

If your financial goals are based on someone else’s highlight reel, you’ll always feel behind. Instead:

- Ask yourself: “What does a good life look like for me — not just what looks good online?”

- Build a budget that supports joy, not deprivation. If your budget feels like punishment, you won’t stick with it.

- Track small wins. Paid off $50 of debt? That’s progress. Celebrating these builds long-term confidence.

Shift from shame-based budgeting to values-based planning. Your money should serve your life — not the other way around.

3. Quit the Comparison Game (It Was Rigged Anyway)

Social media is full of luxury aesthetics, but what it hides is context — the credit card debt, the family money, the brand sponsorships.

- Curate your feed like your mental health depends on it — because it does.

- Replace “Why don’t I have that?” with “What matters most to me right now?”

- Remember: True wealth isn’t loud. It’s quiet, stable, and often invisible online.

You’re not behind. You’re just living in reality. And that’s worth more than a rented Lamborghini on TikTok.

4. Get Help — Money Is Emotional, and That’s Okay

You wouldn’t DIY your mental health or dental surgery — so why do we expect ourselves to navigate financial trauma alone?

- Consider working with a financial therapist who understands the emotional roots of money behaviors.

- Look into money mindset coaches, especially those who specialize in unlearning scarcity beliefs.

- Join communities or courses that support financial healing — sometimes just hearing “me too” is transformative.

Financial growth isn’t just about math. It’s about emotional safety. That’s where real change happens.

5. Rewire the Script: From Scarcity to Enoughness

One of the deepest roots of money dysmorphia is the fear that there will never be enough. But this fear rarely comes from our bank accounts — it usually comes from childhood, culture, or chronic comparison.

Here’s how to start rewriting the script:

- Name your core beliefs about money. (“I’ll never have enough.” “I have to hustle to be safe.” “I’m bad with money.”)

- Challenge them. Where did you learn that? Is it true, or just familiar?

- Replace them with truth-based mantras: “I am allowed to feel secure.” “I can build stability without extremes.” “Wealth includes peace.”

The goal isn’t to be rich. It’s to feel safe and supported — with or without millions in the bank.

Final Thought: You Can’t Heal What You Hate

If you’re trying to fix your finances from a place of self-loathing, it won’t stick. But if you approach it with curiosity, compassion, and courage? You don’t just change your money habits — you change your whole relationship with yourself.

You’re not lazy.

You’re not irresponsible.

You’re not “bad with money.”

You’re learning to unlearn. That’s hard work — and it’s the most valuable investment you’ll ever make.

Amazon Books Recommendation Section

These books explore themes related to money psychology, financial anxiety, and wealth perception:

1. The Psychology of Money

- Author: Morgan Housel

- Why It’s Recommended: Explores how emotions and mindset shape financial decisions.

- Find it on Amazon: Here

2. Mind Over Money: The Psychology of Money Management

- Author: Claudia Hammond

- Why It’s Recommended: Examines how financial beliefs impact spending habits.

- Find it on Amazon: Here

3. Your Money or Your Life

- Author: Vicki Robin & Joe Dominguez

- Why It’s Recommended: Helps readers rethink their relationship with money.

- Find It on Amazon: Here

4. The Financial Diet: A Total Beginner’s Guide to Getting Good with Money

- Author: Chelsea Fagan

- Why It’s Recommended: Offers practical advice for overcoming financial anxiety.

- Find It on Amazon: Here

These books provide valuable insights into money dysmorphia, financial stress, and wealth perception.

Conclusion: Seeing Money Clearly — Beyond the Numbers

Money dysmorphia goes far deeper than typical financial stress. It warps how we feel about our wealth, twisting reality into a constant battle between fear and illusion. Whether you’re clutching your savings tightly out of anxiety or overspending to keep up appearances, this hidden mindset quietly sabotages your financial peace.

In a world dominated by social media’s curated success stories and an ever-present culture of comparison, it’s no wonder many struggle to trust their own financial story. Add layers of past trauma or scarcity thinking, and it becomes clear why money dysmorphia is so common — and so challenging.

But here’s the hopeful truth: by grounding yourself in financial mindfulness, setting goals that honor your unique life, and stepping away from comparison traps, you reclaim control not just over your money, but over your emotional well-being.

True financial health isn’t measured in bank balances alone. It’s found in confidence, clarity, and the quiet assurance that you’re managing your money on your own terms. Recognizing money dysmorphia is the essential first step on that journey — one that leads not only to better finances but to genuine freedom.

FAQ’s

What causes money dysmorphia?

Money dysmorphia is often caused by financial anxiety, social comparison, and past money experiences

How does social media contribute to money dysmorphia?

Seeing curated lifestyles and luxury spending online can distort financial expectations and fuel impulsive spending.

Can money dysmorphia affect wealthy individuals?

Yes—some wealthy individuals hoard money out of fear, while others overspend despite financial instability.

How can I overcome money dysmorphia?

Practicing financial mindfulness, setting realistic goals, and avoiding comparison traps can help.

Is financial therapy helpful for money dysmorphia?

Yes—financial therapy can help individuals reframe their money mindset and reduce financial anxiety.