Introduction

With AI tools like ChatGPT becoming more sophisticated, many people are wondering: Can an algorithm handle my money better than a human advisor? The short answer? Not entirely—but it’s more complicated than that.

While AI-powered platforms are excellent at crunching numbers and delivering instant answers, real-world financial planning is about much more than data. Human advisors bring decades of experience, emotional intelligence, and a deep understanding of how markets react—not just to numbers, but to people.

That said, AI isn’t just a flashy chatbot—it can actually be really smart with your money. From automating budgets to simplifying complex investment strategies, ChatGPT and similar tools are already transforming the way people think about personal finance.

In this article, we’ll explore five crucial money moves that AI actually gets surprisingly right—and we’ll also point out where it still can’t compete with a seasoned professional.

How AI is Reshaping Budgeting and Expense Tracking (And Who Should Actually Be Using It)

In a world where every minute and every dollar counts, managing money manually just doesn’t cut it anymore. Enter AI-powered financial tools like ChatGPT—designed not only to automate but to revolutionize the way we track spending, build budgets, and make smarter financial choices.

While traditional budgeting apps rely heavily on manual data entry and static templates, AI is bringing a new level of intelligence to the game. From recognizing your subscription habits to alerting you before you go off-budget, artificial intelligence is transforming budgeting from a chore into a personalized, automated experience.

The Real Advantages of AI in Budgeting: Smarter, Not Just Faster

AI isn’t just about doing things faster—it’s about doing them better. Here’s how AI tools give you a real edge when managing your money:

- Automatic Expense Categorization

Say goodbye to manually tagging every cup of coffee. AI algorithms automatically identify and classify your transactions—whether it’s groceries, gas, or gym memberships—making your spending habits crystal clear. - Intelligent Alerts & Financial Nudges

AI doesn’t just track your spending—it learns from it. If your spending suddenly spikes in a category, smart tools notify you instantly, helping you course-correct before it snowballs. - Predictive Budgeting

Using historical spending data, AI can forecast future expenses, allowing you to plan ahead more accurately. It’s like having a financial GPS that warns you before you hit a pothole. - Goal-Based Financial Coaching

Want to save for a vacation or knock out debt faster? AI tailors savings plans to your income, goals, and lifestyle—making the impossible feel achievable.

💡 Example: Many AI tools now automatically detect unused subscriptions—like that streaming service you forgot about—and suggest canceling them, which can quietly save you hundreds over time.

Who Gets the Most Value from AI-Driven Budgeting?

AI budgeting isn’t just for the tech-savvy—it’s a lifeline for people navigating modern financial challenges. Here’s who benefits the most:

- Families & Everyday Consumers: Manage household expenses and build emergency funds without needing to be a finance pro.

- Freelancers & Gig Workers: With irregular income, AI helps smooth out cash flow and highlights spending patterns that are easy to overlook.

- Small Business Owners: Automate bookkeeping basics and keep tabs on cash flow with minimal effort.

Top AI-Driven Budgeting Apps Worth Trying

Ready to let AI take the wheel? These apps are leading the charge in smart money management:

| AI Tool | Best For | Key Features |

| Mint | Everyday budgeting | Auto-categorization, budget insights, and bill tracking |

| PocketGuard | Overspending prevention | Real-time alerts and a “safe-to-spend” balance view |

| YNAB | Long-term financial planning | AI-enhanced zero-based budgeting and future-focused goal setting |

| Goodbudget | Cash-style envelope budgeting | Digital envelopes meet AI tracking for disciplined spending |

| Empower | Total financial health | Smart budgeting plus investment and retirement planning in one |

| Tiller Money | Data geeks & custom budgets | Automates Google Sheets for full control over every cent |

The Trade-Off: What AI Budgeting Gets Right (And What It Still Can’t Do)

AI Budgeting Advantages:

- Saves time with fully automated tracking and categorization

- Provides proactive alerts to help curb impulsive spending

- Customizes savings plans based on your behavior, not just generic rules

Limitations of AI Budgeting:

- Lacks human empathy—can’t help when you’re financially overwhelmed or facing tough life decisions

- Doesn’t adapt well to sudden life shifts like illness, layoffs, or divorce

- Many advanced features are locked behind paywalls or subscriptions

Can AI Do Investment Research Better Than a Human? Here’s Where It Excels—and Where It Doesn’t

Investment research has always been at the heart of smart financial decision-making. Traditionally, this has meant relying on seasoned advisors who use a blend of experience, intuition, and industry insight to guide strategy. But artificial intelligence is beginning to change that equation—dramatically.

AI-powered tools, such as ChatGPT and other machine learning platforms, are enabling investors to analyze data on a scale that simply isn’t humanly possible. These systems can process real-time financial news, market indicators, and historical stock data in seconds, offering insights that would otherwise take days to compile.

While AI doesn’t replace the nuance of human judgment, it’s becoming an indispensable part of how investors—from casual traders to institutional giants—gather and interpret information.

How AI Is Transforming Investment Research

AI tools are not just faster—they’re fundamentally changing how investment decisions are made. Here are the key ways in which AI is redefining investment research:

- Instant Market Data Analysis

AI can process live market feeds, economic reports, and corporate financials in real time—eliminating the delays associated with manual research. - Advanced Pattern Recognition and Forecasting

By analyzing historical data, AI identifies recurring patterns and uses predictive analytics to forecast market movements with a high degree of accuracy. - Sentiment Analysis at Scale

AI algorithms can evaluate the tone of news stories, social media chatter, and investor sentiment to uncover signals of market momentum or anxiety—often before the market reacts. - Intelligent Portfolio Optimization

Using risk profiling, investment goals, and current market conditions, AI can suggest data-driven asset allocation strategies tailored to an individual or institutional investor.

Real-world example: Some AI-driven platforms are capable of simultaneously evaluating thousands of stocks, surfacing undervalued assets that human analysts might easily overlook.

Who Benefits Most from AI Investment Tools?

AI investment research isn’t just for hedge funds or tech firms—it offers distinct advantages across a range of investor types:

- Retail Investors

Individuals managing their own portfolios can now access insights and tools previously reserved for professionals, allowing for more confident, data-informed decision-making. - Institutional Investors

Hedge funds and asset managers use AI to improve strategy execution, uncover inefficiencies, and stay competitive in fast-moving markets. - Financial Analysts

AI supports professional analysts by automating data collection, validating forecasts, and helping refine complex financial models.

Top AI-Powered Tools for Smarter Investment Research

These platforms combine robust data analytics with AI capabilities, helping investors of all types navigate the markets more effectively:

| AI Tool | Best For | Key Features |

| Morningstar Quantitative Research | Stock and ETF evaluations | AI-enhanced financial modeling, valuation metrics, and risk assessment |

| Zacks Investment Research | Forecasting and rankings | Predictive stock scoring and trend analysis using AI algorithms |

| Zacks Investment Research | Strategic portfolio building | AI-based valuations and sentiment analysis on stocks and sectors |

| Bloomberg Terminal AI | Professional market analysis | Real-time AI-powered market analytics, economic data, and financial modeling |

| Yahoo Finance AI Tools | Retail investor support | AI-assisted stock screeners, trend tracking, and investment ideas |

Weighing the Pros and Cons of AI in Investment Research

Strengths:

- Rapid processing of massive datasets across multiple markets

- Consistent pattern recognition and forecasting based on hard data

- Removes emotional bias from investment analysis

Limitations:

- Cannot fully interpret complex, real-world events such as political shifts or black swan events

- Lacks the intuition to anticipate market sentiment before it forms

- Still requires human interpretation to shape actionable investment strategies

AI is revolutionizing the landscape of investment research. Its speed, depth of analysis, and ability to uncover patterns across massive datasets make it an invaluable asset for investors at all levels.

However, while AI can surface insights and suggest strategies, it lacks the judgment, experience, and long-term perspective that human advisors bring to the table. For now, the strongest approach combines the best of both worlds: let AI handle the data—and let humans handle the decisions.

AI and the Future of Retirement Planning: A Smarter Way to Prepare for Long-Term Financial Security

Planning for retirement is no longer just about setting aside a portion of your paycheck each month. Today, it’s about making informed, strategic decisions that span decades—decisions that must adapt to changing markets, tax laws, and personal life events. Artificial intelligence is making this process more accessible and precise than ever before.

While traditional financial advisors offer customized plans based on years of experience and client relationships, AI-powered platforms bring something equally valuable to the table: real-time analysis, predictive modeling, and the ability to simulate hundreds of future financial outcomes—all within seconds.

Let’s explore how AI is changing the retirement planning landscape—and who stands to benefit the most.

How AI Is Changing Retirement Planning (And Why It Matters)

AI is no longer a futuristic concept in financial services. It’s already transforming how individuals build and manage their long-term financial plans. Here’s where AI tools are making a measurable impact:

- Dynamic Retirement Savings Projections

AI calculates how much money you’ll need to retire based on your age, income, spending habits, life expectancy, and even inflation forecasts—offering far more accurate and personalized estimates than generic calculators. - Optimized Investment Strategies for Retirement

Based on your risk tolerance and retirement timeline, AI suggests asset allocation strategies that balance growth potential with stability, adjusting automatically as you near retirement age. - Tax-Efficient Withdrawal Planning

AI helps minimize the tax impact of retirement withdrawals by identifying the most efficient sequence and timing for drawing from different accounts (e.g., IRAs, 401(k)s, taxable accounts). - Integrated Benefit Analysis

AI systems evaluate government benefits like Social Security and pensions, guiding you on when and how to claim them to maximize your income over time.

Example: Some platforms allow you to simulate early retirement, market downturns, or unexpected medical expenses—giving you a clear picture of how each factor could affect your financial future.

Who Should Be Using AI for Retirement Planning?

AI-driven retirement tools are particularly effective for individuals at different life stages, each with unique financial needs:

- Young Professionals

Early-career individuals can benefit from AI tools that calculate optimal contribution levels and highlight the long-term value of starting early—even with modest amounts. - Pre-Retirees

Those within 10 to 15 years of retirement gain from simulations that incorporate real-time market data, project pension and Social Security payouts, and analyze spending assumptions. - Current Retirees

AI supports retirees in managing withdrawals, planning for healthcare costs, and maintaining income stability while avoiding unnecessary tax liabilities.

Top AI-Powered Retirement Planning Tools Worth Exploring

These platforms leverage AI to help users plan for retirement more strategically and confidently:

| AI Tool | Best For | Key Features |

| Personal Capital Retirement Planner | Projecting long-term savings | AI-based simulations, investment planning, and cash flow analysis |

| NewRetirement | End-to-end retirement planning | Scenario modeling, tax planning, and Social Security optimization |

| Empower Retirement | Institutional retirement analysis | Pension and benefit modeling with AI-driven forecasting |

| Fidelity Retirement Score | Retirement readiness assessments | AI evaluates current savings against projected retirement needs |

| T. Rowe Price Retirement Calculator | Customized planning strategies | Uses AI to recommend asset allocation and withdrawal tactics |

The Strengths and Shortcomings of AI in Retirement Planning

What AI Does Well:

- Generates highly personalized retirement savings targets

- Creates investment strategies that evolve with changing conditions

- Minimizes tax liabilities through optimized withdrawal planning

What AI Still Can’t Do:

- Account for emotional factors like fear of outliving savings or the desire to leave a legacy

- Handle highly nuanced financial situations involving multiple income streams or estate planning

- Replace the empathy and real-world experience of a financial advisor during major life transitions

AI is not here to replace your financial advisor—it’s here to amplify your ability to make informed, data-driven decisions. For many people, AI tools offer a level of clarity and control that was previously out of reach.

Yet, even with the precision of predictive analytics and the convenience of automated forecasting, human judgment remains critical—especially when your future income, health, and lifestyle are at stake.

The best approach? Let AI power your plan, and let human insight guide your strategy.

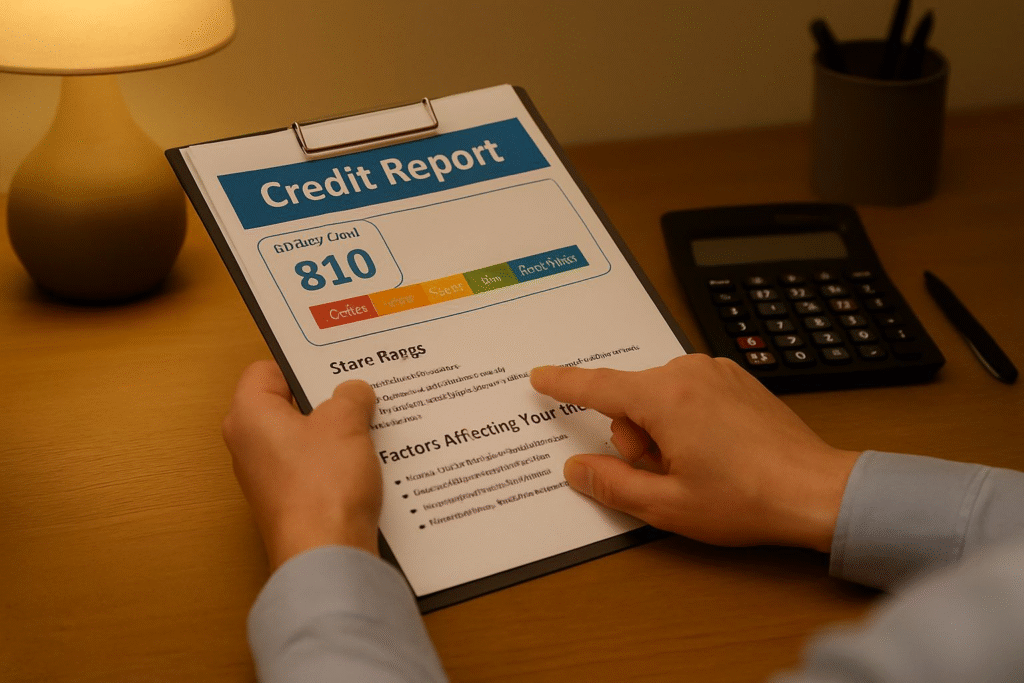

Smarter Debt Management and Credit Score Growth with AI: Useful, but Not Foolproof

Managing debt and building a strong credit score are two of the most important — and emotionally loaded — parts of personal finance. In the past, individuals often relied on credit counselors, spreadsheets, or trial and error. Today, AI-powered platforms offer an alternative: automated debt tracking, personalized repayment suggestions, and credit insights in real time.

But while these tools can save time and offer convenience, they’re not a cure-all. In fact, they sometimes oversimplify financial complexity or miss the emotional nuance behind debt decisions.

Let’s explore how AI is changing the debt landscape — and where its limits become clear.

What AI Gets Right in Debt Management

AI isn’t inherently “smart” — it’s trained to detect patterns and process large amounts of financial data quickly. When used well, it can help users navigate debt more efficiently.

- Customized Repayment Plans

AI can analyze your income, spending, and interest rates to recommend whether you should follow the avalanche method (tackling high-interest debts first) or snowball method (clearing smaller debts to gain momentum). - Real-Time Credit Monitoring

Tools powered by AI track changes in your credit score and offer tips on how to improve — such as reducing credit utilization or avoiding hard inquiries. - Debt Consolidation Analysis

AI can crunch the numbers and tell you whether rolling multiple debts into a single loan makes sense based on your current financial profile. - Predictive Interest Rate Scanning

Some platforms compare available loan or refinancing offers, suggesting ways to reduce borrowing costs based on your credit standing.

In short: AI helps users stay on top of logistics — interest rates, balances, payment timing — with less manual work.

Where AI Falls Short (And Sometimes Flat-Out Fails)

Despite the efficiency, AI tools have limitations — and they become obvious once you step outside clean, predictable financial patterns.

- No Understanding of Personal Context

AI doesn’t know if you’re caring for a sick parent, facing legal troubles, or recovering from a financial trauma. It can’t distinguish between a temporary cash-flow crunch and a deeper systemic issue. Human advisors, by contrast, can tailor advice based on your lived reality. - Can’t Negotiate or Advocate on Your Behalf

Creditors don’t negotiate with algorithms. When you need someone to call a lender, request fee waivers, or build a hardship case — AI is of no use. - Assumes Rational Behavior

AI assumes you’ll follow a plan it generates — but debt management is as much emotional as mathematical. Real people make inconsistent choices, delay payments due to stress, or avoid looking at bills altogether. A financial coach understands this. A bot does not.

Who Actually Benefits from AI-Driven Debt Tools?

AI tools work best in structured, stable situations. For example:

- People with predictable income who just need help choosing the most efficient debt strategy

- Young professionals or students trying to build credit from scratch

- Homebuyers preparing their credit profile for mortgage approval

In contrast, if you’re juggling multiple jobs, have recently gone through divorce or job loss, or are dealing with collection agencies, a human advisor may be far more effective.

Top AI-Powered Tools — and What They’re Really Good At

| Tool | Best For | What It Actually Helps With |

| Experian Boost | Thin credit files | Adds on-time bill payments (like Netflix) to credit profile |

| Tally | Credit card debt automation | Makes payments on your behalf, optimizing for interest savings |

| Credit Karma | Credit tracking + product matching | Monitors score, recommends loans or credit cards |

| Self Financial | Building or rebuilding credit | Uses small loans to help establish payment history |

| Debt Payoff Planner | DIY debt strategizing | Helps compare avalanche vs. snowball payoff timelines |

These tools can make debt more manageable — but they aren’t financial therapists, legal advisors, or miracle workers.

AI tools are valuable for automating the technical side of debt: tracking balances, recommending strategies, and highlighting trends. They shine in consistent, low-emotion scenarios where data is clean and goals are clear.

But financial life isn’t always clean or consistent. Sometimes you need someone to talk to, someone to strategize with, or someone to just listen. And in those moments, an algorithm can’t match the value of a trusted human expert.

Use AI to simplify. Use people to strategize. And don’t let either one do your thinking for you.

Financial Education & Money Mindset Coaching: What AI Can (and Can’t) Teach You About Money

Financial education isn’t just about numbers — it’s about habits, beliefs, and the long-term relationship you have with money. That’s why many people turn to coaches, courses, and books to reshape not just how they spend and save, but how they think about wealth.

Today, AI-powered platforms are stepping into this space, offering instant answers, simplified learning, and personalized financial content. But while AI can explain the “how,” it often misses the “why.” It can teach tactics — not transformation.

Let’s explore where AI shines in financial education, and where human insight still leads.

What AI Does Well in Financial Literacy

AI isn’t intuitive, but it’s fast, consistent, and scalable. When used in financial education, it offers powerful support — especially for those starting from zero.

- Personalized Learning Paths

Instead of one-size-fits-all content, AI can adjust financial lessons based on your current knowledge, goals, and even spending behavior. - Simplifying Complex Ideas

Whether it’s compound interest, capital gains taxes, or risk-adjusted returns — AI can break down technical concepts into digestible explanations. - Behavioral Nudges Based on Data

By analyzing your spending or saving patterns, AI can highlight where your habits clash with your goals, and suggest behavioral shifts accordingly. - Simulation-Based Learning

AI-powered platforms can simulate real-world financial decisions — like investing during a downturn or budgeting with fluctuating income — to let users practice without the stakes.

In short: AI helps deliver timely, tailored knowledge to help people understand how financial systems work — and where they might be falling short.

But Here’s Where AI Stops Being Useful

As powerful as it is, AI struggles when financial learning becomes personal, emotional, or psychological.

- No Empathy or Real Accountability

AI can tell you that you overspent on dining last month. It can’t ask why you were emotionally drained and needed comfort food after a 12-hour shift. It doesn’t hold you accountable like a coach would. - Mindset Shifts Require Human Support

Changing a scarcity mindset, overcoming generational money trauma, or building confidence around investing — these are deeply human challenges that can’t be solved with a chatbot. - Over-Reliance on Generic Advice

AI may default to “save 20% of your income” or “diversify your investments,” but those suggestions mean little without understanding the context of someone juggling debt, supporting family, or living in a volatile economy.

Who Actually Gains the Most from AI-Driven Financial Learning?

AI tools are best suited for individuals who need structure, not therapy. People who want information, not introspection.

- Beginners Who Don’t Know Where to Start

If you need to learn what a Roth IRA is or how credit scores work, AI can walk you through it quickly and clearly. - Entrepreneurs Learning Cash Flow Basics

For small business owners, AI can explain business budgeting, taxes, or pricing strategies without the jargon. - Self-Starters Looking to Supplement Coaching

Those who already have a growth mindset can use AI to reinforce what they’re learning from books, mentors, or financial coaches.

Top AI Tools in Financial Education — and What They’re Actually Good At

| Tool | Best For | What It Really Offers |

| Financial Mindset Coaching | Building habits | AI-generated prompts and goal-setting routines to reinforce positive behavior |

| Nadia AI | New investors | Clear explanations of finance topics + investing simulations |

| WallStreet School AI | Advanced learners | Technical finance skills like modeling and valuation |

| ICA Edu Skills | Career-focused learners | AI-assisted vocational finance training, great for entry-level professionals |

AI-driven financial education tools are opening doors — giving people access to information that used to be locked behind jargon, advisors, or expensive courses. That’s a step forward.

But understanding money isn’t just about knowledge. It’s about confidence, emotion, and behavior. AI can’t change your money mindset — only you (with the right support) can do that.

Use AI to learn the facts. Use human mentors to transform your financial beliefs.

Amazon Books Recommendation Section

These books explore themes related to AI in finance, financial planning, and investment strategies:

1. Advanced ChatGPT Frameworks for Financial Advisors

- Author: Leonardo Caldeira

- Why It’s Recommended: Explores how AI is transforming financial advisory services, with insights from Wall Street firms like Morgan Stanley and Goldman Sachs.

- Find it on Amazon: Here

2. ChatGPT Millionaire: Leveraging Artificial Intelligence for Financial Goals

- Author: Khuong Envy

- Why It’s Recommended: Discusses how AI can help individuals optimize budgeting, savings, and investment strategies.

- Find it on Amazon: Here

3. Building Your Money Machine with ChatGPT

- Author: Larry Wheeler

- Why It’s Recommended: Covers how AI can automate financial decision-making and create profitable online businesses.

- Find it on Amazon: Here

These books provide valuable insights into AI-driven financial planning, investment strategies, and wealth-building techniques

Conclusion

AI-powered tools like ChatGPT are transforming financial decision-making, offering quick, data-driven insights for budgeting, investment research, and financial education. However, while AI excels at processing vast amounts of financial data, it lacks human intuition, emotional intelligence, and personalized financial planning.

Human financial advisors provide tailored strategies, factoring in life circumstances, tax implications, and long-term financial goals—areas where AI still falls short. The best approach? A hybrid model, where individuals leverage AI for instant financial insights while consulting human advisors for personalized guidance.

As AI continues to evolve, its role in finance will expand, but human expertise remains irreplaceable in navigating complex financial decisions. The future of financial planning lies in combining AI efficiency with human wisdom, ensuring individuals make informed, strategic, and emotionally sound financial choices.

Let me know if this conclusion aligns with your vision, or if you’d like any refinements!

FAQ’s

Can ChatGPT replace financial advisors?

Not entirely. While ChatGPT and other AI tools can offer quick, data-driven insights, they can’t replace the depth of personalized planning that a human advisor provides. Advisors bring real-world experience, long-term strategy, and the emotional intelligence needed for navigating life’s financial uncertainties — like job changes, family planning, or market downturns.

Bottom line: AI is a helpful supplement, not a substitute.

Is AI reliable for investment advice?

AI can process vast amounts of data and identify potential market trends faster than most humans. However, it doesn’t account for individual risk tolerance, tax planning, or personal financial goals. Investment advice from AI should always be reviewed in the context of your broader financial situation.

Think of it this way: AI spots patterns. Advisors build strategies.

How does AI help with budgeting?

AI excels at automating budgeting tasks that once took hours. From categorizing transactions to flagging overspending and recommending savings goals, tools like Mint, YNAB, and PocketGuard help users stay on track with minimal manual input. Some even use predictive analytics to forecast future expenses.

Useful for: Streamlining day-to-day money management — especially if you’re not naturally budget-minded.

What are the risks of relying on AI for financial decisions?

AI has limitations. It doesn’t understand emotional decision-making, can’t adjust to every financial curveball (like sudden job loss), and may miss nuances in tax law or estate planning. There’s also the risk of relying too heavily on generic advice without professional context.

In short: AI is only as good as the data and design behind it — and your ability to apply its insights wisely.

Should I use both AI and a financial advisor?

Yes — for most people, a hybrid approach works best. Use AI tools for routine tasks (like budgeting, alerts, or investment tracking), and consult a financial advisor for strategy, goal-setting, and life planning. The combination offers efficiency, insight, and long-term guidance.

Best of both worlds: AI for speed and scale, human advice for depth and nuance.