Introduction

Stepping into the world of investing can feel a lot like being dropped in a foreign country without a map. Terms fly at you—NAV, equity, diversification—while the markets rise and fall like tides. It’s enough to make anyone hesitate. But what if there was a strategy so simple, so consistent, that even a complete beginner could confidently take their first step toward building wealth? That’s exactly what a Systematic Investment Plan (SIP) offers.

Rather than demanding a large lump sum right from the start, SIP lets you ease into investing by contributing modest amounts at regular intervals—monthly, weekly, or as it suits you. It’s a no-pressure, steady approach that aligns beautifully with your long-term goals. What makes SIP truly powerful is how it leverages the magic of compounding—where your money starts earning returns, and those returns begin generating their own returns. It’s like planting a tree and watching it bear fruit, then watching that fruit sprout new trees of its own.

More importantly, SIP removes the stress of trying to “time the market”—something even seasoned investors struggle with. Instead of gambling on perfect moments, you’re developing a habit: investing consistently, rain or shine. Over time, this strategy helps even out market volatility and builds financial discipline, which is arguably more valuable than chasing short-term gains.

This guide isn’t just another dry rundown of finance jargon. Whether you’re curious about the best SIP plans in 2025, new to mutual funds, or simply looking for a no-nonsense way to start growing your money, we’re here to walk you through how to start SIP in a clear, step-by-step manner. You’ll gain insight into how SIPs actually work, what makes them tick, and how to unlock their full potential.

In today’s world—where uncertainty is the only constant—taking charge of your financial future isn’t optional, it’s essential. And there’s no better place to begin than with a well-structured, thoughtfully planned SIP. Let’s begin the journey—one smart step at a time.

What is a SIP? Understanding the Basics of Systematic Investment Plans

For many people just beginning their investment journey, the biggest challenge isn’t the market itself—it’s deciding how to step in. Should you invest everything at once and hope for the best? Or take a more measured, calculated path? That’s where the Systematic Investment Plan, or SIP, comes into play—a strategy that’s as smart as it is simple.

Breaking Down SIP Investment

At its core, a Systematic Investment Plan (SIP) is a structured approach to investing in mutual funds. Instead of putting down a large sum in one go, you invest smaller, fixed amounts at regular intervals—often monthly. This allows you to gradually build your portfolio without feeling the pinch on your monthly budget.

Think of SIP as your financial gym membership. You don’t bulk up overnight; you show up consistently, and over time, the results speak for themselves. SIP follows the same philosophy. Through steady contributions and the compounding effect, even modest amounts grow exponentially over the years. It’s not about timing the market—it’s about spending time in the market.

This makes SIP incredibly accessible, especially for young professionals, students, or anyone who wants to start investing without pressure. You don’t need to be a financial expert—you just need to be consistent.

SIP vs Lump Sum: Which is Better for Beginners?

This is a classic question. Should you go all-in or pace yourself?

Let’s break it down:

- SIP Investment: A fantastic entry point for beginners. It smooths out the impact of market ups and downs by spreading your investment across time. You invest during market highs and lows alike, which reduces the average cost of buying mutual fund units—a principle known as rupee-cost averaging. It builds the habit of saving while cushioning you from short-term volatility.

- Lump Sum Investment: More suited for seasoned investors who have a large corpus ready and understand how to read market trends. While it has the potential for high gains if timed right, it also carries the risk of investing just before a market downturn.

With SIP, you’re not trying to “beat the market”—you’re working with it, consistently, patiently. Over the long run, that patience often outperforms risky short-term plays.

SIP for Beginners: A Stress-Free Investment Start

If you’re just stepping into the world of finance, SIP is more than just a method—it’s a mindset. It nurtures financial discipline, introduces you to market behavior gradually, and helps you set realistic, long-term goals. Most importantly, it removes the pressure of having to “know everything” right away.

In a world obsessed with fast returns, SIP offers something refreshingly different: sustainable wealth building, one small step at a time.

Benefits of SIP Investment: Why It’s a Smart Choice for Beginners

If you’ve ever hesitated to invest because the market felt too risky or too complex, you’re not alone. The good news? You don’t need to be a financial expert to grow your wealth. Systematic Investment Plans (SIPs) are designed to remove the stress, the guesswork, and the fear from investing—especially if you’re just starting out.

Here’s why SIP isn’t just a beginner-friendly option—it’s a smart, strategic move toward long-term financial success.

1. Power of Compounding: Turning Time into Wealth

At the heart of SIP’s effectiveness is the quiet force of compounding. When you invest regularly, your returns don’t just sit there—they start generating their own returns. Over time, this compounding snowballs into massive growth.

Let’s put it into perspective:

Invest just ₹5,000 per month for 20 years in a fund averaging 12% annual return. Your total invested amount? ₹12 lakh. But thanks to compounding, your wealth doesn’t stop there—it could grow to over ₹50 lakh. That’s over four times your principal, earned just by staying consistent.

Compounding rewards patience and discipline, not flashy short-term moves. That’s the real magic.

2. Rupee-Cost Averaging: Invest Smarter, Not Riskier

Markets go up and down—that’s their nature. Trying to “buy low and sell high” sounds easy, but even seasoned investors often get it wrong. SIP removes this pressure entirely through rupee-cost averaging.

Here’s how it works:

When the market dips, your fixed SIP amount buys more mutual fund units. When it rises, you buy fewer units. Over time, this balances out the cost of your investments, lowering your overall risk and smoothing out the volatility. You stop reacting emotionally to market swings and let the system work for you.

3. Flexibility & Convenience: Your Money, Your Rules

SIP isn’t rigid or complicated. It adapts to your life. You can:

- Start with as little as ₹500 per month

- Increase contributions as your income grows

- Pause or stop without penalties

- Choose frequencies that suit your schedule—monthly, weekly, quarterly

This flexibility makes SIP a perfect fit for young earners, students, or anyone managing multiple financial priorities. No pressure, no hard commitments—just smart, stress-free investing.

4. Passive Investing That Builds Real Habits

Unlike stock trading, SIP doesn’t demand your time or emotional energy. Once set up, your contributions are automatic. You don’t need to watch the markets every day, read the news obsessively, or guess the “right” time to invest.

This makes SIP a powerful behavioral tool. It turns saving into a habit. It introduces structure into your finances. And over time, it helps you think long-term instead of reacting to every market hiccup.

5. Goal-Oriented Wealth Building

SIP isn’t just about making money—it’s about building a financial foundation. Whether you’re planning for retirement, your child’s education, or a dream home, SIP lets you attach your investments to real-life goals.

By aligning your SIPs with timelines and target amounts, you bring clarity and purpose to your financial journey. The best part? The earlier you begin, the more advantage you give to compounding—and the easier it becomes to meet those goals without financial strain.

Step-by-Step Guide to Start a SIP

Starting a Systematic Investment Plan (SIP) isn’t just easy—it’s one of the most efficient ways to build long-term wealth while keeping your investment process disciplined and stress-free. If you’re new to the world of mutual funds, this step-by-step guide walks you through everything you need to know to launch your SIP journey with clarity and confidence.

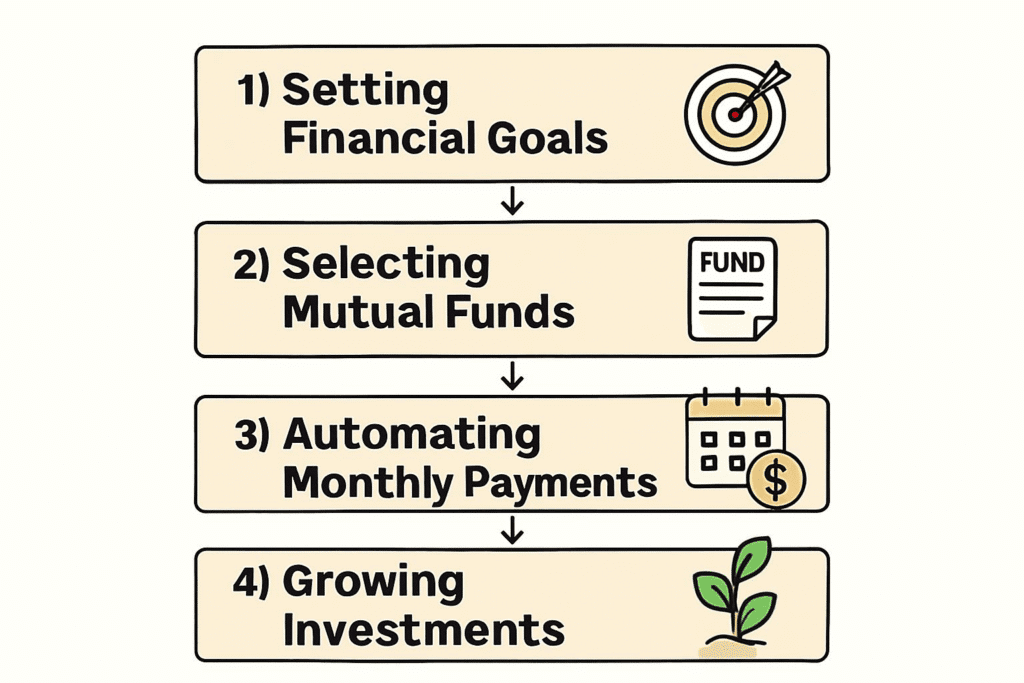

1. Set Clear Financial Goals Before You Begin

Every investment needs a destination. Before jumping into any SIP, take a moment to define:

- What are you investing for? (e.g., wealth creation, early retirement, buying a house, child’s education)

- How long do you plan to invest? (short-term, medium-term, or long-term goals)

- What level of risk can you tolerate? (conservative, balanced, aggressive)

Answering these questions will help you choose the right type of mutual fund for your SIP. For example:

- Equity funds may suit long-term growth

- Debt funds may be better for short-term or low-risk goals

- Hybrid funds can work if you want a balance between safety and growth

2. Select the Mutual Fund That Matches Your Needs

Choosing the right fund is critical, not just convenient. Look at:

- Type of Fund – Equity for growth, debt for safety, hybrid for balance

- Past Performance – Focus on consistency over 5-10 years, not just flashy short-term returns

- Expense Ratio – A lower ratio means more of your money stays invested

- Fund Manager – Experience and track record of the fund manager can influence stability

Avoid chasing trends. Focus on long-term fundamentals that align with your personal financial goals.

3. Use an SIP Calculator to Plan Ahead

An SIP calculator isn’t just a fancy tool—it gives you a clear picture of how much to invest and what returns you might expect over time.

Let’s say:

- You invest ₹10,000/month

- You aim for a 12% annual return

- You continue this for 15 years

The calculator will show your wealth could potentially grow beyond ₹50 lakh. This kind of clarity helps in setting realistic targets and adjusting contributions over time.

4. Choose Where You’ll Invest

There are several platforms where you can start your SIP, each with different levels of convenience and cost:

- Through Your Bank – Secure, but sometimes with limited fund options

- Investment Apps & Online Portals – Easy setup, great for beginners, often with direct plans

- Direct from AMC (Asset Management Companies) – Often lowest-cost (zero-commission) route

Make sure the platform is SEBI-registered, transparent about fees, and offers easy tracking of your SIPs.

5. Decide the Amount and Frequency of Your SIP

Your SIP amount should feel manageable today, but meaningful for tomorrow.

- Monthly SIP – Most common; great for salaried individuals

- Weekly SIP – Good for those who want micro-investing habits

- Quarterly SIP – Works for freelancers or irregular income earners

You don’t need a big amount to start—₹500/month is enough to begin. The key is consistency, not size.

6. Register Your SIP and Automate Payments

Once you’ve selected the fund and SIP amount, you’ll need to:

- Complete KYC – Submit PAN, Aadhaar, address proof, and bank details

- Choose SIP Start Date – Select when the auto-debit should begin

- Set Auto-Payment – Link your bank account and automate it so you never miss an installment

Automation builds a system where investing becomes effortless. You don’t think about it—it just happens.

7. Review and Adjust as Your Goals Evolve

Starting a SIP isn’t the end—it’s the beginning of a dynamic process. You’ll need to check in annually or semi-annually to:

- Increase SIP amounts as your income grows

- Review fund performance and replace underperforming ones

- Rebalance your portfolio if your risk appetite or financial goals shift

Treat your SIP like a growing plant—it needs occasional care, but no overwatering.

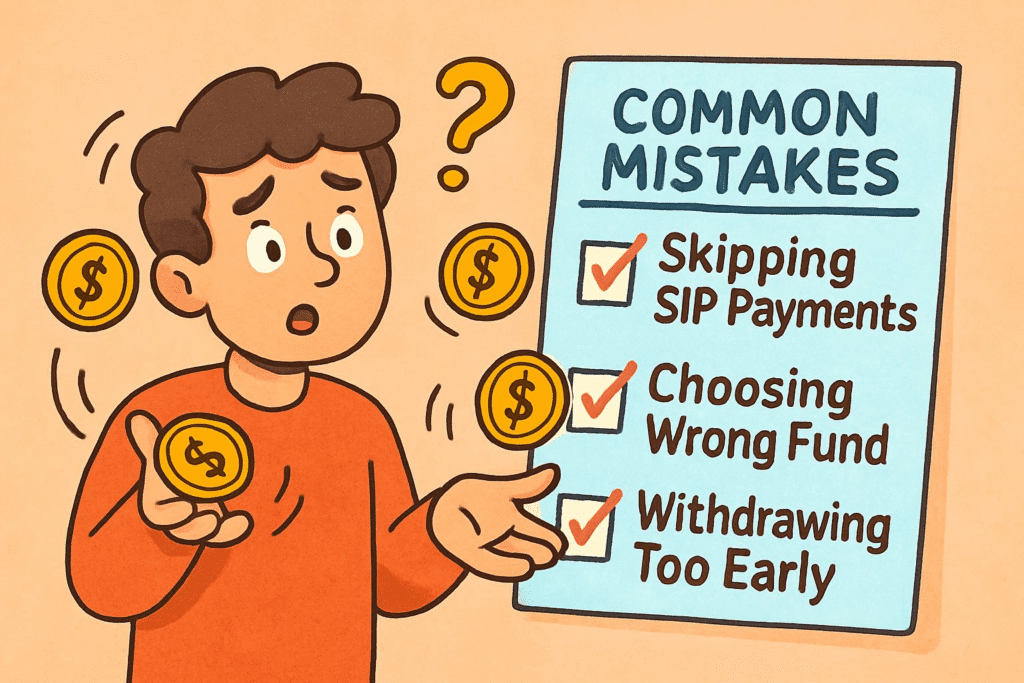

Common Mistakes to Avoid When Starting a SIP

Even though a Systematic Investment Plan (SIP) offers one of the most beginner-friendly paths to building wealth, it’s surprisingly easy to fall into traps that slow down or even damage your investment growth. Knowing what to avoid is just as important as knowing what to do. Here’s a breakdown of the most common mistakes people make when starting a SIP—and how to dodge them from day one.

1. Jumping In Without Clarity or Research

The biggest misstep many beginners make is treating SIP like a blind subscription—signing up without any planning.

Ask yourself:

- What am I investing for?

- What’s my investment time frame?

- What kind of risks am I comfortable with?

Avoid selecting funds just because they’re popular or had high returns last year. Every fund has a specific risk-return profile, and without aligning it to your personal financial goals, you may end up with disappointing results.

💡 Tip: Always evaluate a mutual fund’s category, risk level, past consistency, and expense ratio before committing.

2. Reacting Emotionally to Market Volatility

This is where many SIP journeys hit a wall. A dip in the market often scares new investors into pausing or withdrawing their SIPs.

But here’s what’s often overlooked:

📉 When the market falls, your SIP buys more units at a lower cost.

📈 When the market rises again, those extra units multiply your gains.

SIP isn’t about short-term performance—it’s a long game. If you cancel SIPs during a downturn, you lose the chance to benefit from rupee-cost averaging, one of SIP’s biggest strengths.

3. Choosing Funds That Don’t Fit Your Profile

It’s easy to be lured by aggressive equity funds promising high returns. But choosing a mutual fund without matching it to your financial profile is like wearing shoes that don’t fit—sooner or later, you’ll feel the pain.

Key things beginners often overlook:

- Type of Fund – Not all SIPs are equity-based; debt and hybrid funds exist for a reason

- Fund Manager Track Record – Past performance alone doesn’t guarantee future success

- Fund Volatility – Some funds swing wildly, which can be unnerving for new investors

Choose funds that fit your risk tolerance, not your appetite for hype.

4. Forgetting to Adjust or Scale SIP Over Time

One powerful aspect of SIP is how flexible it can be. But many people start a fixed SIP and never touch it again—even when their income or savings potential increases.

Here’s why that’s a problem:

- Inflation eats into returns over time

- Your future goals might require more capital than you initially estimated

- A static SIP limits your ability to fully leverage the power of compounding

📌 If your income increases, consider a step-up SIP or manually revise your monthly contribution every year.

5. Treating SIP Like a Short-Term Parking Spot

SIP isn’t designed for quick exits. But too many beginners treat it like a savings account—pulling funds early because they feel bored, impatient, or need emergency cash.

This breaks the whole idea of compounding. Just when your money begins to generate serious growth, you interrupt it.

⏳ SIP returns are heavily backloaded—the biggest gains usually happen after the 5–10 year mark. Pulling out too soon leaves that wealth on the table.

Unless absolutely necessary, let your SIP investments run their full course.

Conclusion

When it comes to starting your investment journey, few methods offer the balance of simplicity, structure, and long-term growth potential that Systematic Investment Plans (SIP) do. Unlike lump sum investing—which often demands perfect timing and larger capital—SIPs empower even first-time investors to begin with modest, manageable contributions and scale up gradually.

What sets SIP apart isn’t just its flexibility or ease of access, but the way it trains you into disciplined wealth creation. Each automated contribution builds a financial habit that most people struggle to develop independently. Over time, this discipline compounds—just like your money does.

For anyone hesitant about entering the world of mutual funds, SIP offers a clear path forward:

- You don’t need to predict market highs and lows.

- You don’t need to be a financial expert.

- You just need to be consistent.

SIP acts as a bridge between where you are and where you want your finances to be—whether that’s early retirement, a child’s education, or long-term security.

So, if you’re weighing options on how to start investing in 2025, SIP isn’t just a “safe” choice—it’s a smart and strategic one.

FAQ’S

How much should a beginner invest in SIP?

Beginners should start with an affordable amount based on their income and financial goals. A good rule of thumb is to invest at least 10-20% of monthly savings into a mutual fund SIP. You can start as low as ₹500 per month and gradually increase contributions as your financial situation improves

What happens if I miss an SIP payment?

If you miss an SIP payment due to insufficient funds, your bank may charge a penalty, but your SIP investment itself remains unaffected. Most platforms allow you to resume SIP from the next scheduled payment without additional charges. To avoid this, always ensure your bank account has enough balance for automatic deductions.

Is SIP better than fixed deposits for passive investing

SIP vs Fixed Deposits depends on your financial goals:

✅ SIP Investment: Higher potential returns, flexible contributions, long-term wealth building

✅ Fixed Deposit: Lower risk, guaranteed returns, better for short-term savings

If you seek higher growth and wealth building, SIP is better than fixed deposits due to compounding and market-linked returns.

Can I withdraw SIP anytime?

Yes, mutual fund SIPs offer liquidity, but early withdrawals may affect returns. Some funds have exit loads, meaning a small fee applies if redeemed before a specific period (usually 1 year). For best SIP plans 2025, check withdrawal rules before investing.

How does an SIP calculator help?

An SIP calculator estimates your future returns based on monthly investment, duration, and expected interest rate. It helps beginners understand how SIP works and set realistic financial goals for long-term investing