Introduction

Effectively managing personal finances can open doors to stability, freedom, and future prosperity. With a myriad of budgeting approaches out there, finding one that feels both practical and adaptable can be a challenge. Among these, the 40-30-20-10 rule emerges as a straightforward strategy that balances essential spending, savings, discretionary funds, and debt repayment.

This method isn’t just about dividing numbers—it’s about fostering healthier financial habits that align with your goals and values. Designed to simplify financial planning, the 40-30-20-10 rule provides clear guidelines on allocating income in a way that promotes both immediate needs and long-term security. Whether you’re saving for a milestone, managing monthly bills, or tackling debt, this rule serves as an excellent tool for finding balance.

In this blog, we’ll delve into the structure of the 40-30-20-10 rule, explore its benefits, and provide actionable steps for implementing it successfully. Whether you’re looking to gain better control of your finances or establish a solid foundation for the future, this budgeting strategy can help you pave the way to financial wellness.

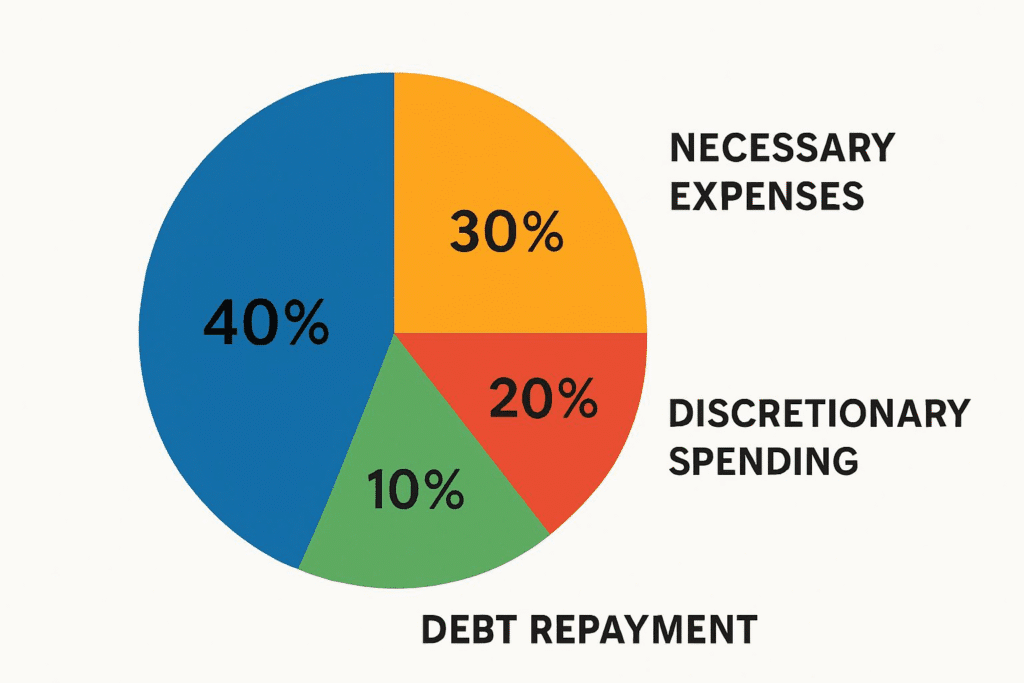

Breaking Down the 40-30-20-10 Rule

The 40-30-20-10 rule divides your income into four distinct categories, each designed to address a specific financial priority. Let’s explore how each portion works and why it’s essential for effective financial management:

1. 40% for Savings

The first and largest allocation, 40%, is dedicated to savings. This ensures that a significant portion of your income is being set aside to secure your financial future. Savings can include:

- Emergency Funds: Cover unexpected expenses like medical bills or car repairs without derailing your budget.

- Retirement Plans: Contribute to long-term accounts like 401(k)s, pension funds, or IRAs, depending on your financial goals.

- Investments: Put money into stocks, mutual funds, or real estate to grow your wealth over time.

Focusing on savings first instills discipline and helps you build financial resilience, ensuring that your future needs are covered.

2. 30% for Necessary Expenses

The second-largest category, 30%, is allocated for essential expenses that sustain daily living. These typically include:

- Housing costs such as rent or mortgage payments.

- Utilities like electricity, water, and internet.

- Groceries and household necessities.

- Transportation costs, including fuel or public transport fares.

This portion covers the non-negotiables in your life—things you cannot do without. By limiting this category to 30%, you gain a better understanding of your essential spending patterns and avoid lifestyle inflation.

3. 20% for Discretionary Spending

Discretionary spending refers to non-essential expenses—things you enjoy but could live without. This 20% allocation allows you to reward yourself without feeling guilty. It can include:

- Dining out, entertainment, and hobbies.

- Vacations or leisure travel.

- Shopping for non-essential items like luxury goods.

Having this category ensures balance in your budget. It gives you the freedom to enjoy life’s pleasures while keeping indulgences under control.

4. 10% for Debt Repayment

Finally, 10% of your income is earmarked for paying off any outstanding debts. Whether it’s credit card balances, student loans, or personal loans, this allocation is crucial for improving your financial health. Paying off debts helps you:

- Reduce interest payments over time.

- Improve your credit score.

- Free up future income for savings or other financial goals.

If you’re debt-free, this portion can be redirected into savings or investments, maximizing your financial growth

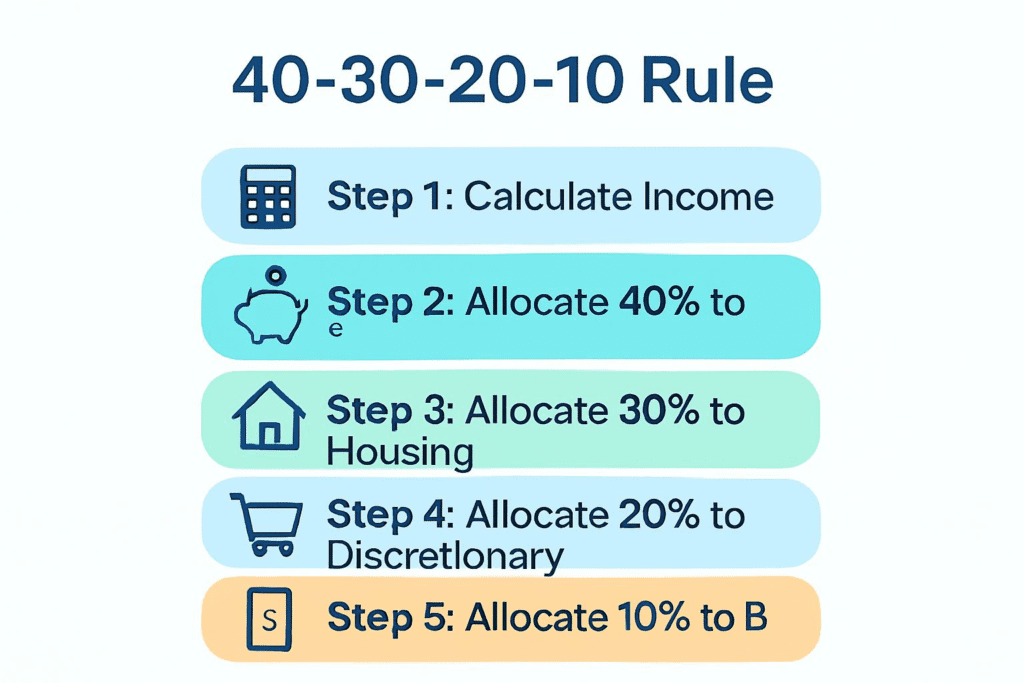

How to Implement the 40-30-20-10 Rule

Applying the 40-30-20-10 rule to your financial life is straightforward, but it requires thoughtful planning and consistent effort. Here’s a step-by-step guide to help you implement this budgeting strategy effectively:

1. Calculate Your Income

Before you can allocate your income, you need to know exactly how much you have coming in. Calculate your total monthly income after taxes, including any additional sources like freelance work, side hustles, or investments. This figure will form the basis for dividing your money into the four categories.

2. Analyze and Categorize Your Expenses

Identify and list all your monthly expenses. Break them down into the following categories:

- Savings: Emergency fund contributions, retirement savings, and investments.

- Necessary Expenses: Rent or mortgage, utilities, groceries, and transportation.

- Discretionary Spending: Dining out, hobbies, entertainment, and luxury purchases.

- Debt Repayment: Loan payments, credit card balances, or other outstanding debts.

This step helps you understand your current spending habits and where adjustments might be needed.

3. Adjust Percentages if Needed

While the 40-30-20-10 rule provides a solid foundation, you may need to tweak it to fit your lifestyle. For example:

- If you’re working to aggressively pay off debt, consider shifting some funds from discretionary spending to debt repayment.

- If you have low essential expenses, you could allocate more toward savings or investments.

The flexibility of this rule allows you to customize it based on your unique financial situation.

4. Set Goals for Each Category

Having clear goals will keep you motivated and focused. For example:

- Savings Goal: Build a six-month emergency fund or contribute a specific amount to retirement.

- Necessary Expenses Goal: Keep spending within the 30% cap to free up money for other categories.

- Discretionary Spending Goal: Use this category to reward yourself without guilt.

- Debt Repayment Goal: Aim to pay off high-interest debt within a set timeframe.

5. Use Tools to Track Your Spending

Tracking your spending is crucial for staying on budget. Leverage technology to simplify this task:

- Budgeting apps like Mint, YNAB (You Need A Budget), or PocketGuard.

- Spreadsheets to manually document income and expenses.

- Automated alerts to track your bank account balances and spending limits.

These tools help you stay accountable and make informed adjustments when needed.

6. Monitor and Refine Your Budget Regularly

Life circumstances change, and your budget should adapt accordingly. Review your budget monthly or quarterly to assess whether you’re meeting your goals. Are your savings growing? Are you managing to stay within your discretionary spending limits? Adjust as necessary to ensure ongoing financial progress.

7. Stay Disciplined

Sticking to a budget requires discipline and consistency. Avoid the temptation to overspend, especially in discretionary areas. Celebrate small wins, like hitting a savings milestone or reducing debt, to stay motivated.

Implementing the 40-30-20-10 rule is not just about following a formula—it’s about building healthy financial habits that align with your priorities. With time and practice, this strategy can empower you to take full control of your finances and achieve long-term stability.

Pros and Cons of the 40-30-20-10 Rule

Pros

1. Easy to Understand and Implement

The simplicity of dividing your income into four distinct categories makes this rule accessible to everyone, regardless of financial expertise. Its clarity removes the guesswork often associated with complex budgeting methods.

2. Promotes Savings and Debt Reduction

By prioritizing savings and debt repayment, this rule fosters financial security and stability. With 40% allocated to savings, you’re actively building wealth and preparing for emergencies, while the 10% for debt repayment ensures consistent progress in reducing liabilities.

3. Balanced Approach to Financial Management

The rule strikes a balance between practicality and enjoyment. It covers essentials, encourages saving, and allows room for leisure spending. This ensures your financial priorities are met without sacrificing fun or relaxation.

4. Adaptability Across Different Lifestyles

Whether you’re managing household expenses, saving for a big purchase, or paying off debt, the 40-30-20-10 rule can be tailored to suit your unique financial situation. Its flexibility allows adjustments to percentages as your needs evolve

Cons

1. May Not Suit High Fixed Costs

Individuals with high necessary expenses, such as rent or childcare, may find it challenging to stick to the 30% allocation for essentials. In such cases, the rule may require significant adjustments to work effectively.

2. Requires Discipline and Consistency

While the rule simplifies budgeting, it still demands commitment. If you’re prone to impulsive spending, maintaining the allocations for savings and debt repayment can be difficult without proper self-control.

3. Limited Flexibility for Significant Debt

For those with large amounts of debt, the 10% allocation might not be sufficient to make meaningful progress. Adjusting percentages to prioritize debt repayment could be necessary in such scenarios.

4. Potentially Overwhelming for Low-Income Households

Low-income individuals might struggle to allocate 40% for savings or 10% for debt repayment, especially if necessities consume a significant portion of their income. Customization may be required to align the rule with their financial realities.

The 40-30-20-10 rule offers a straightforward framework for managing finances, but it’s essential to assess its compatibility with your unique circumstances. By weighing these pros and cons, you can determine whether this budgeting approach aligns with your financial goals and lifestyle.

Conclusion

Managing your finances effectively is a cornerstone of achieving both stability and freedom. The 40-30-20-10 rule offers a structured yet flexible approach to budgeting that emphasizes savings, ensures essential expenses are covered, balances leisure spending, and prioritizes debt repayment. By following this method, you can lay a solid foundation for long-term financial success.

Throughout this blog, we’ve explored how the 40-30-20-10 rule works, its benefits, and its potential challenges. By breaking down your income into clear categories, this rule simplifies financial planning and promotes healthier habits. Whether you’re striving to pay off debt, save for major life goals, or simply gain better control over your spending, this budgeting strategy can be an invaluable tool.

However, it’s important to remember that financial plans are not one-size-fits-all. The 40-30-20-10 rule provides a framework, but customization is key to aligning your budget with your unique circumstances and goals. Regularly reviewing and refining your allocations ensures that your financial strategy remains relevant and effective.

Adopting the 40-30-20-10 rule isn’t just about managing money—it’s about empowering yourself to make informed decisions, reduce stress, and achieve financial security. With patience, discipline, and consistency, you can transform your financial outlook and pave the way for a brighter, more prosperous future.

FAQ’s

How is the 40-30-20-10 rule different from the 50-30-20 rule?

The 50-30-20 rule is a popular budgeting method where 50% of your income is allocated to necessary expenses, 30% to discretionary spending, and 20% to savings and debt repayment. In contrast, the 40-30-20-10 rule shifts the focus significantly toward savings, dedicating 40% of income to this category while dividing the remaining 60% among necessary expenses, discretionary spending, and debt repayment. The 40-30-20-10 rule places greater emphasis on financial security and proactive saving.

Can the rule be customized to suit my financial situation?

Absolutely! The 40-30-20-10 rule is a flexible framework that can be tailored to your unique financial priorities. For instance, if you need to repay significant debt, you can allocate a larger percentage to debt repayment by adjusting discretionary spending. Similarly, if you have minimal necessary expenses, you can allocate more to savings or discretionary spending.

Is this rule suitable for people with low income?

Yes, though adjustments might be necessary. Individuals with lower incomes may find it challenging to dedicate 40% to savings or 10% to debt repayment if their necessary expenses consume a large portion of their earnings. In such cases, shifting percentages and focusing on small, consistent savings goals can still provide structure and lead to financial improvement over time

What if I have no debt to repay?

If you’re debt-free, you can repurpose the 10% allocation for debt repayment into other financial goals. For example, you might redirect it toward building an emergency fund, investing in assets, or contributing more to retirement savings. The rule remains versatile, even for those with zero liabilities.

Are there tools to help me implement this rule?

Yes, there are several budgeting tools and apps designed to make financial planning easier. Popular options include:

Mint: Tracks your expenses and categorizes them automatically.

YNAB (You Need A Budget): Focuses on proactive budgeting to help you manage spending and savings.

PocketGuard: Ensures you don’t overspend by showing what’s left after covering bills, goals, and necessities.

Additionally, simple spreadsheets or financial software like Microsoft Excel can help you customize and track your budget manually.

What are the long-term benefits of following the 40-30-20-10 rule?

Adopting this budgeting strategy can lead to numerous long-term benefits, such as:

Building a robust emergency fund and financial safety net.

Reducing stress by systematically tackling debt.

Encouraging disciplined saving habits for significant future goals, like homeownership or retirement.

Offering financial flexibility and resilience during unexpected events